salt tax impact new york

In this episode of the SALT Shaker Podcast Eversheds Sutherland Associates Jeremy Gove and Chelsea Marmor dive in to the. The tax plan signed by President Trump in.

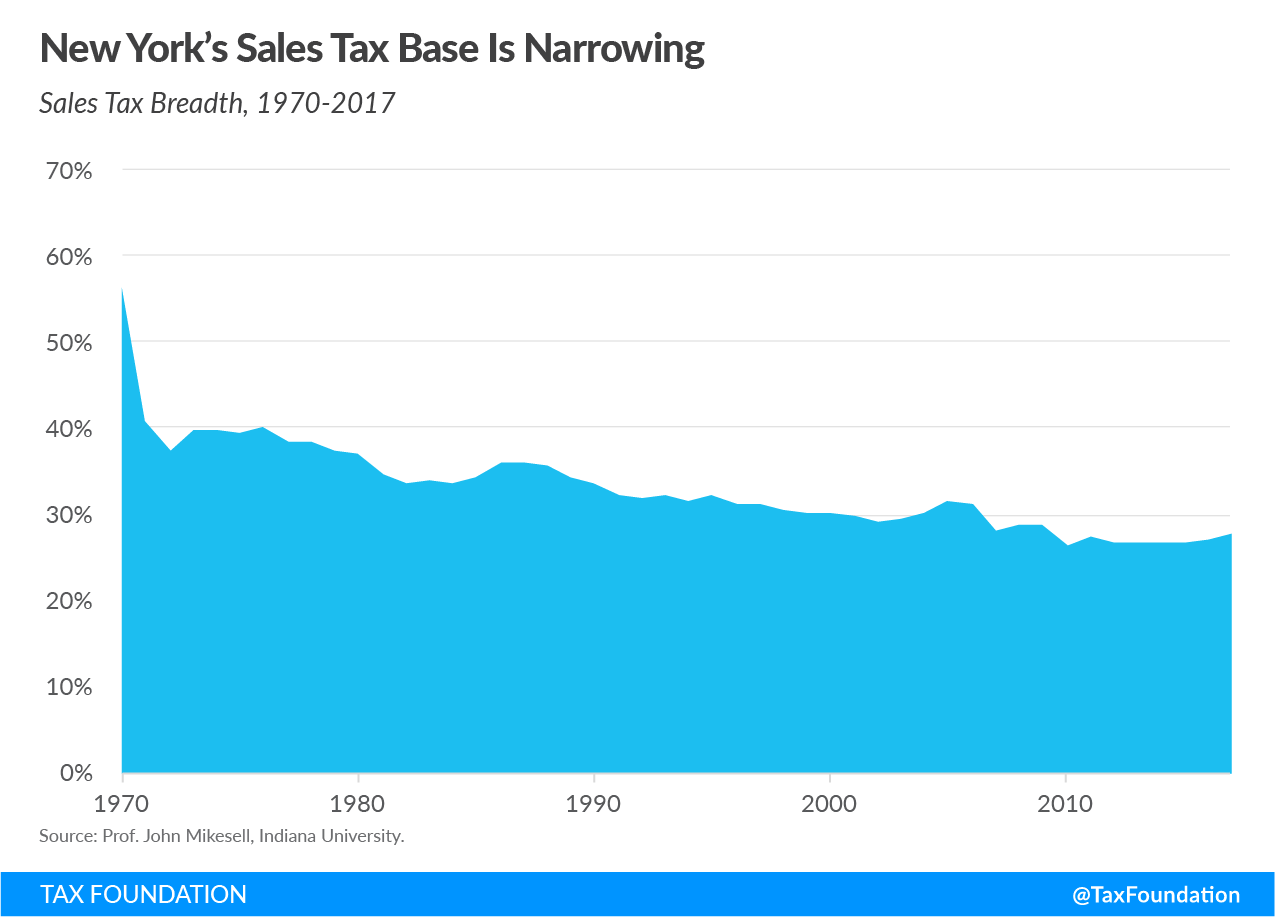

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

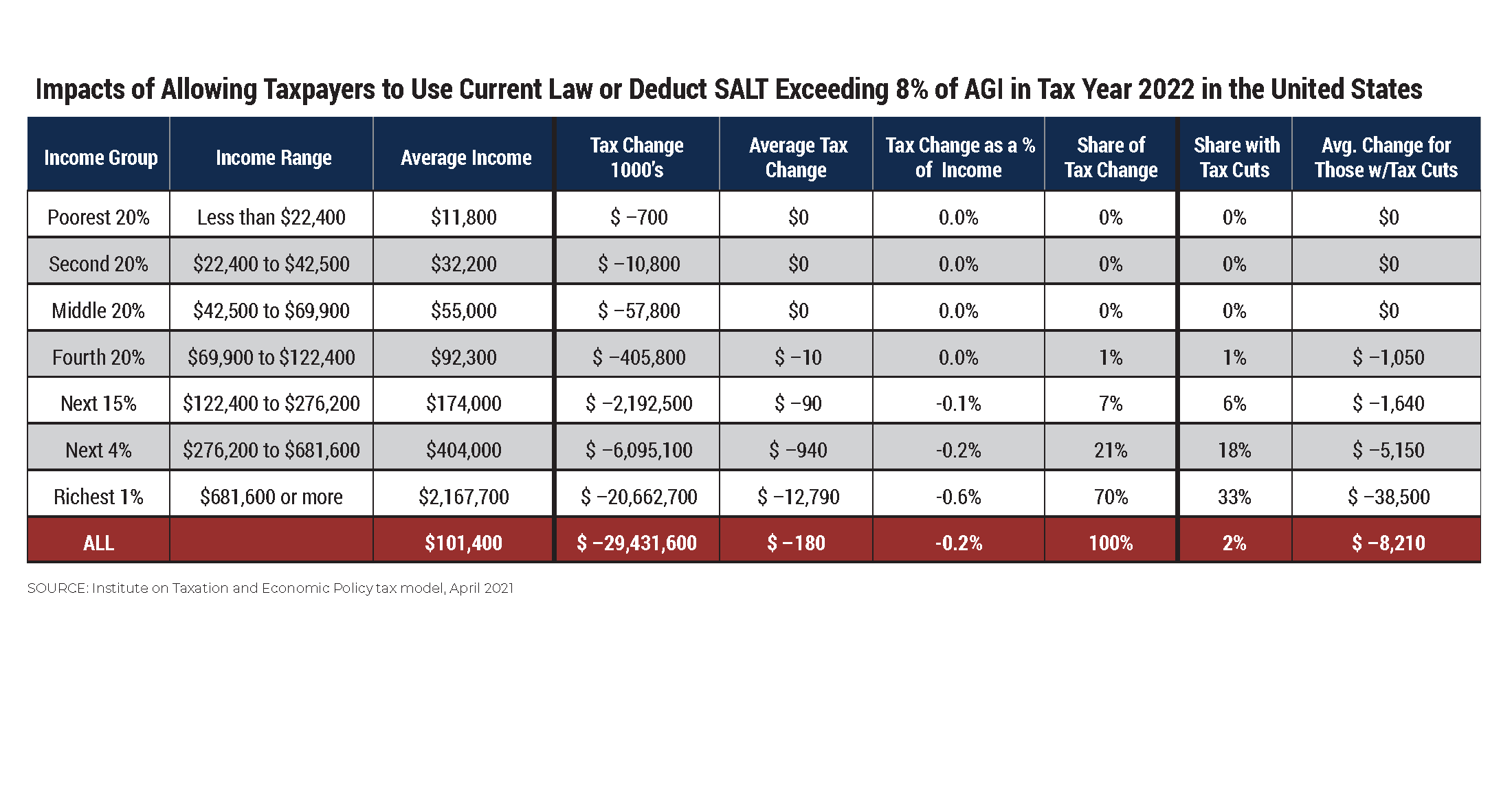

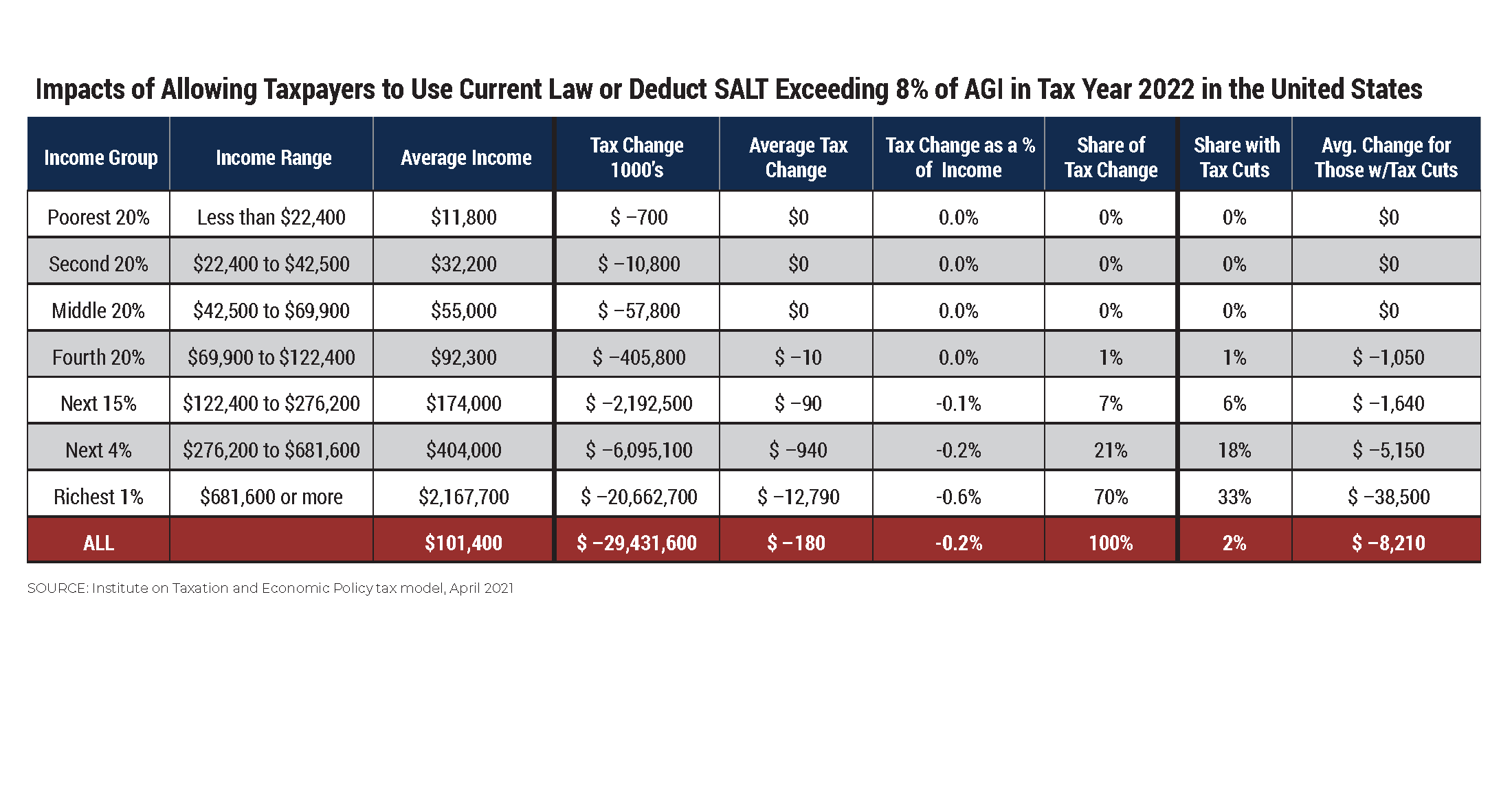

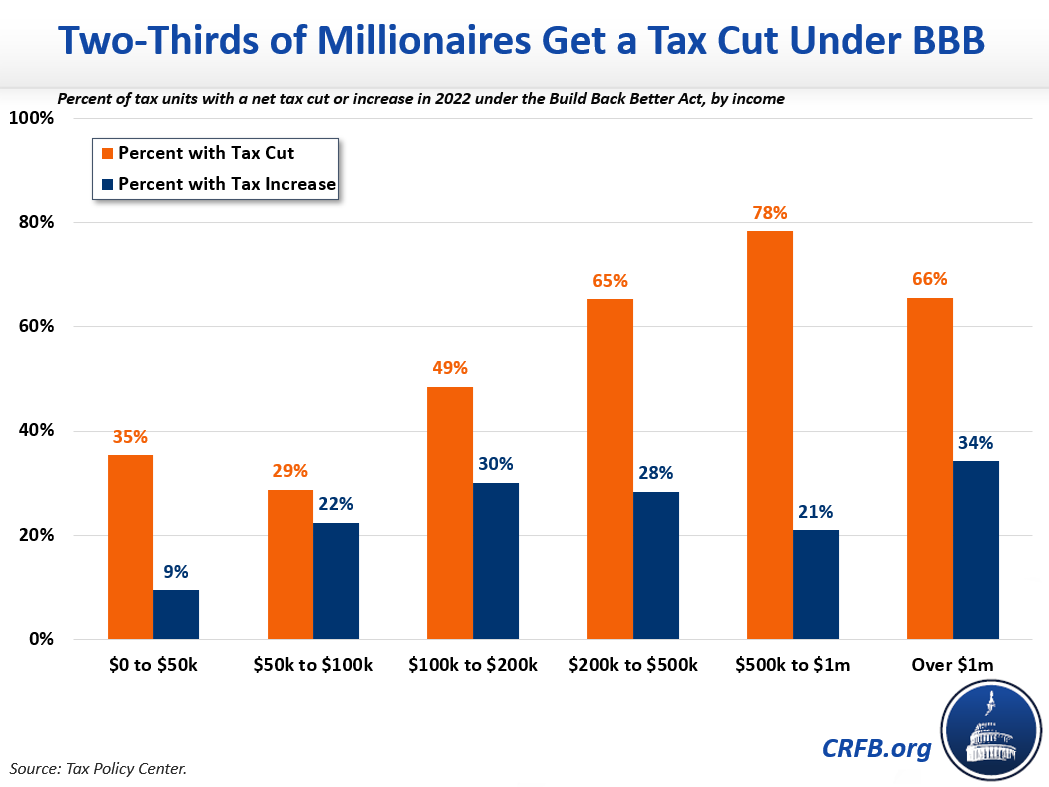

57 percent would benefit the top one percent a cut of.

. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. Thats because the tax credit New York offers isnt dollar for dollar. After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion for FY 2020 thus resulting in a.

New York has issued long. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. The cap on the SALT deduction has been a body blow to New York and middle-class families throughout the country.

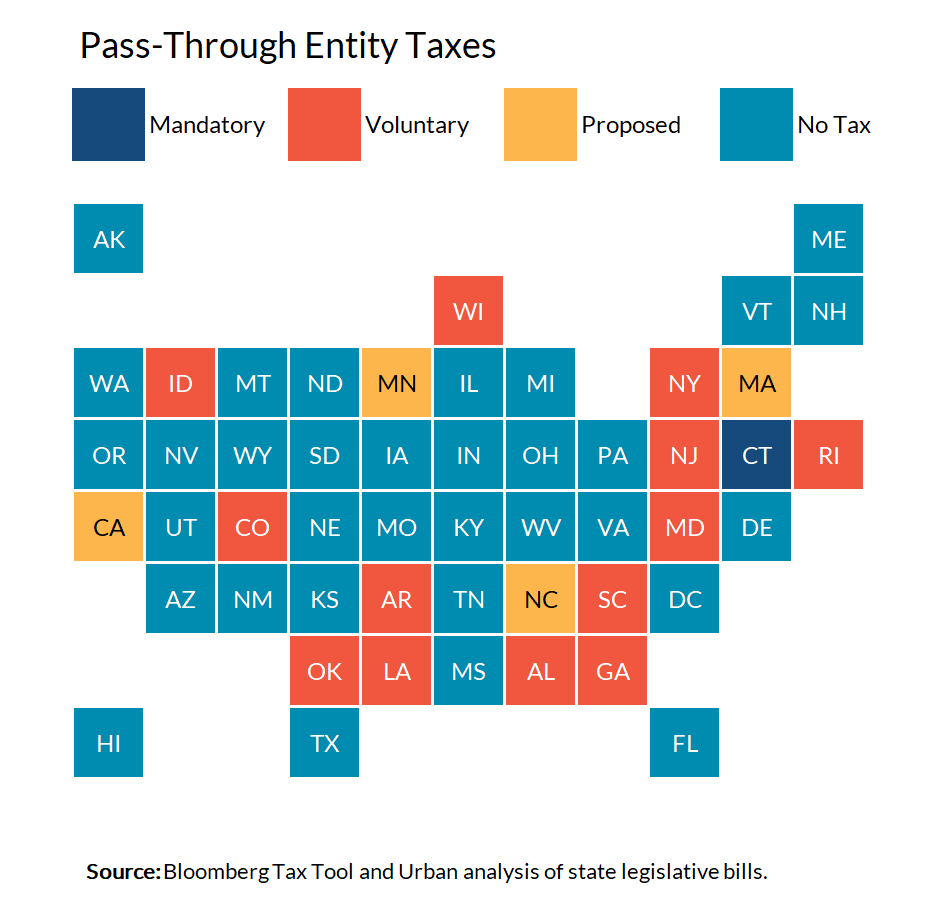

This report shows that the cap which is effectively a tax. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. Although the return of the full SALT deduction would benefit some high-net-worth families the impact would be far more profound on the many middle-class and senior-citizen.

The new New York. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently. Its 85 percent for state tax liability and 95 percent for local liability.

Late last year the IRS issued a notice which allowed the deductibility of the entity-level tax in calculating flow-through income of the entity owner blessing this version of the. Corporate tax reform edition. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Those affected by the 10000 SALT limit are affluent homeowners with the ability to make a lot of political noise he said and many have benefited from other provisions of the. Over the coming months we will work with House Leadership.

The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. Cuomo repeatedly has claimed that the SALT cap is costing New Yorkers up to 15 billion a year in higher federal taxes.

This number apparently is an estimate of the amount New. Someone trying to convert 50000 in state.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Tax Deduction Forbes Advisor

Why This Tax Provision Puts Democrats In A Tough Place Time

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Nyc Home Prices Plunge After Salt Deductions Capped

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Pin By Laura Batson On Sauces Brown Cups Taste Made Worcestershire Sauce

This Bill Could Give You A 60 000 Tax Deduction

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget